Value Creation

The Importance of Growth and ROIC

Sep 17, 2024

Creating shareholder value is a critical goal for any company. At its core, this involves growing and earning a return on capital that exceeds the cost of that capital. While short-term gains might be tempting, the key to sustained value creation lies in prioritizing long-term prospects and adhering to fundamental principles. This blog post explores how companies can achieve this by focusing on growth and return on invested capital (ROIC).

The Long-Term Perspective on Value Creation

As shareholders, we invest with the expectation that companies will create value over time. However, this is not merely about delivering short-term profits. Companies must resist the temptation to cut costs on vital activities such as marketing and R&D for immediate gains, as these can stifle future growth. Instead, maintaining a long-term perspective is crucial for sustained value creation.

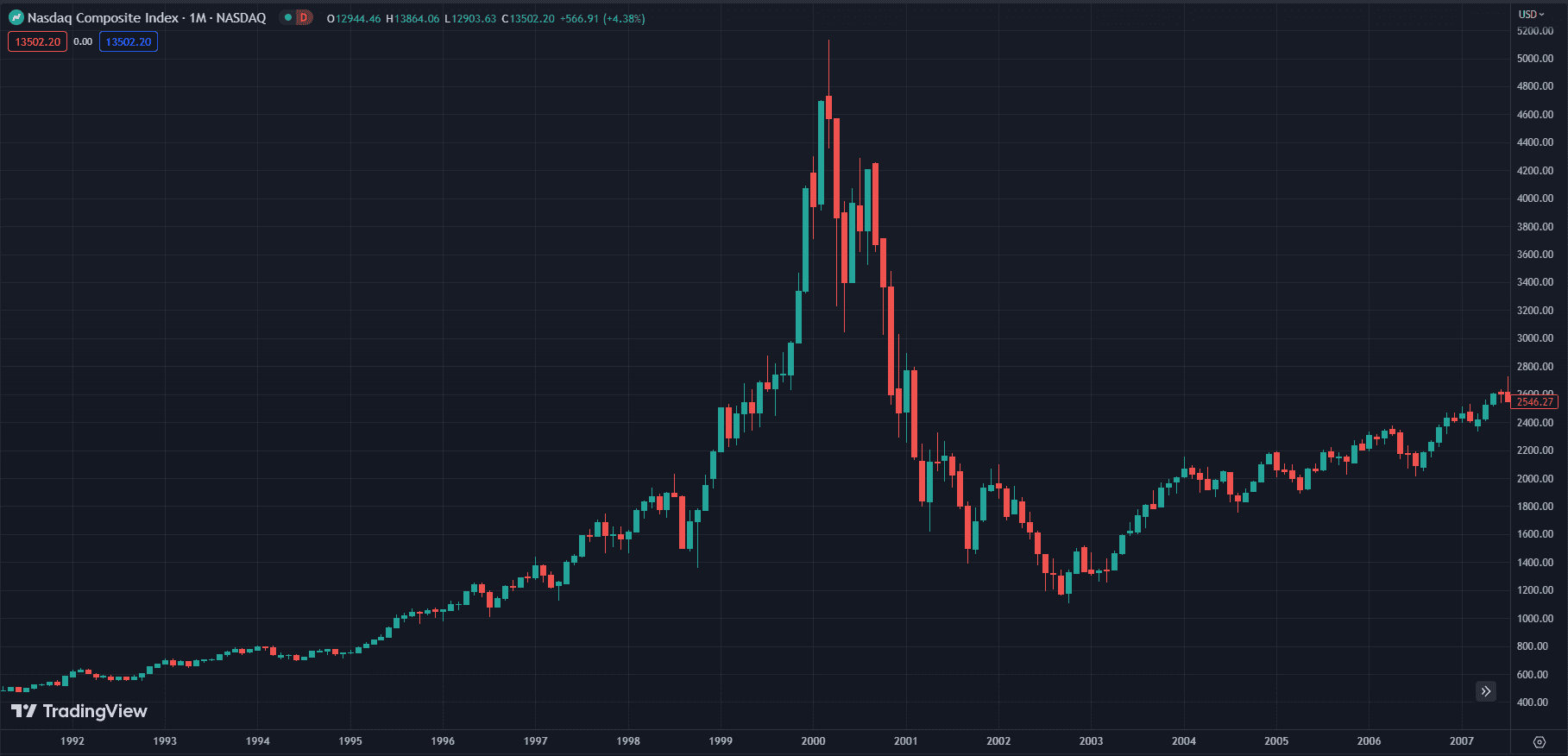

Lessons from Financial Crises

History has shown that neglecting fundamental principles of value creation can lead to catastrophic outcomes. The Global Financial Crisis of 2008-2009 and the dot-com crash of the early 2000s are prime examples where deviations from value fundamentals resulted in massive value destruction. These events underscore the importance of adhering to sound value creation principles to avoid similar pitfalls.

Sustaining High Rates of Return

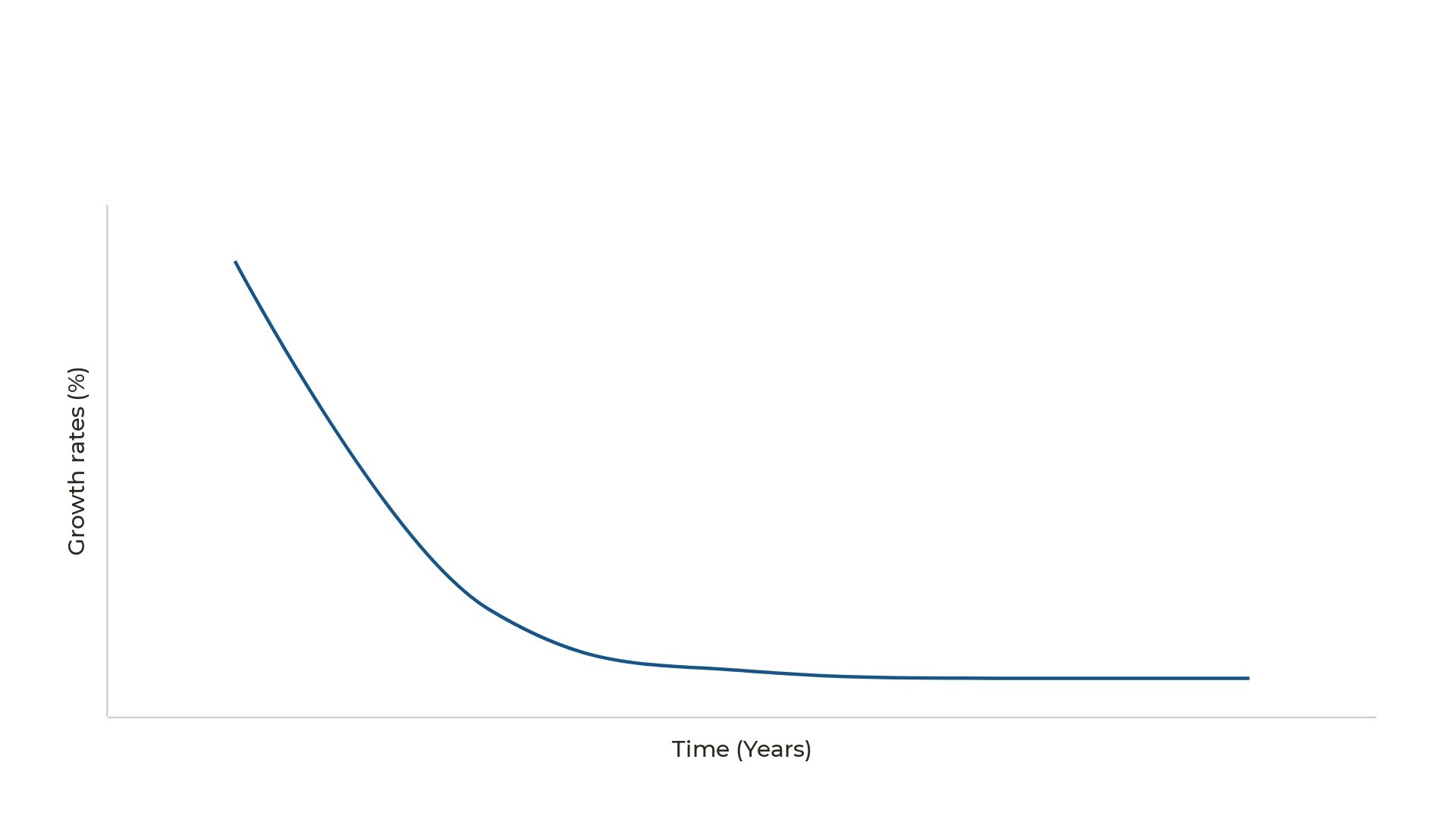

For companies to consistently create value, they must grow sustainably at high rates of return. This ability is closely linked to a company’s competitive advantages and how effectively it can maintain them. Competitive pressures will inevitably arise, eroding these advantages over time. Therefore, companies must proactively seek new sources of competitive advantage to ensure long-term success.

Measuring Success with ROIC

Return on invested capital (ROIC) is a crucial metric that links a company’s profitability to its invested capital. Companies that consistently earn a higher return on invested capital than their cost of capital create more value. High ROIC often indicates a competitive advantage, making it a valuable indicator of a company’s potential for long-term success.

Industry Dynamics and Competitive Advantage

The profitability of a company is heavily influenced by the industry it operates in. Some industries, such as mining, require significant investments and produce commoditized products, making it hard to maintain high returns on invested capital. In contrast, branded consumer goods often provide greater opportunities for higher returns due to the power of their brand names and the ability to command premium prices.

Maintaining Competitive Advantage

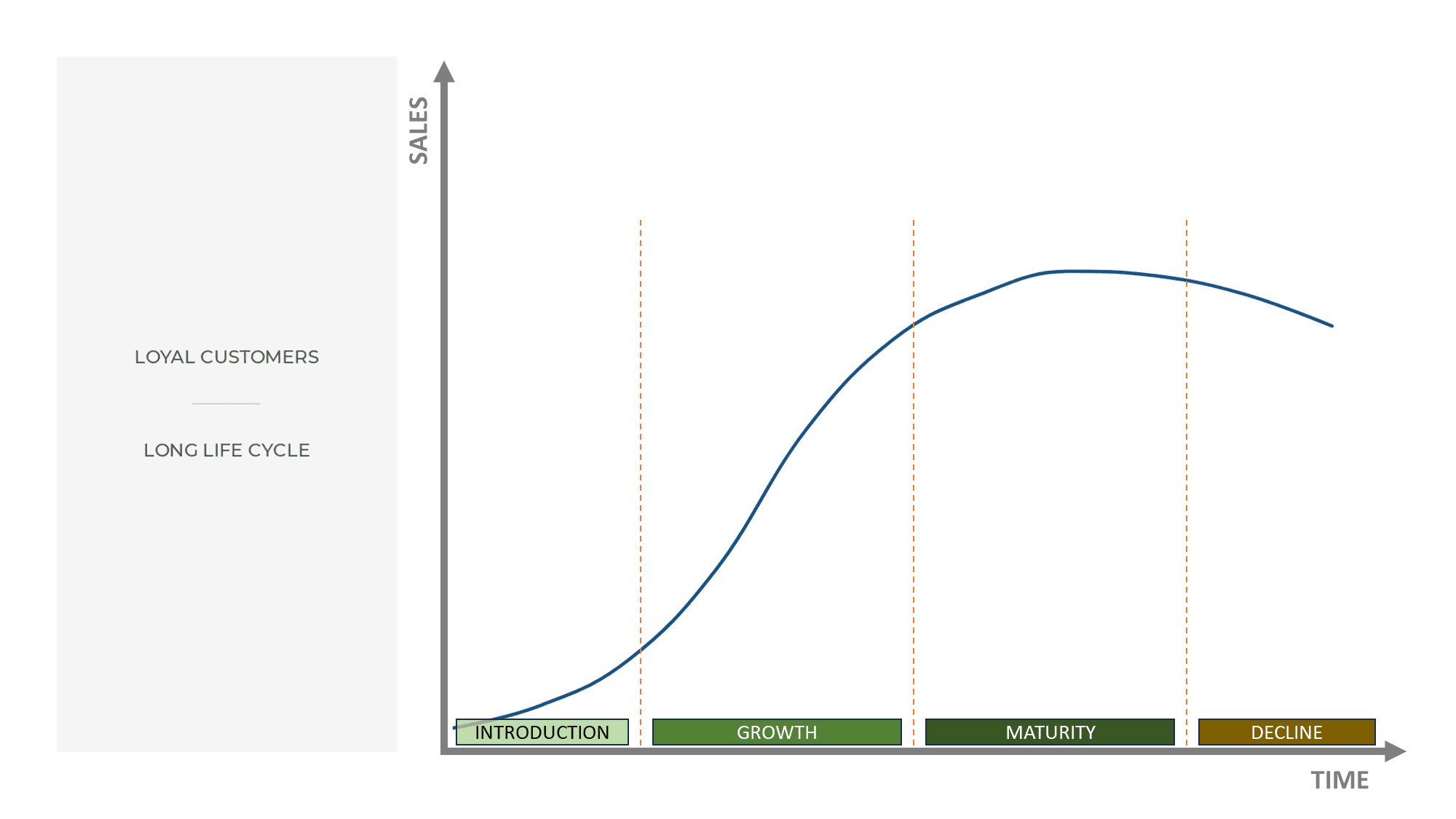

The ability of a company to sustain above-average returns depends on several factors, including the length of a product’s life cycle, the uniqueness of its business model, and its capability to renew products and services regularly. Companies with strong brands and innovative products are typically better positioned to maintain their competitive advantage over time.

Practical Implications for Valuation

When valuing companies, it’s practical to consider their ability to sustain high returns on invested capital. McKinsey’s research shows that top-performing companies usually maintain their competitive advantages, allowing them to earn above-average returns consistently. This insight is crucial when calculating the terminal value for such companies, as their returns can justifiably be assumed to remain above the industry average.

Sources of Competitive Advantage

Competitive advantages can arise from various sources. McKinsey groups these into three categories:

Price Premium: Companies can charge more for their products if they are differentiated by brand, quality, or innovation.

Cost and Capital Efficiency: Companies that operate more efficiently than competitors can deliver products at lower costs or generate more products per unit of capital.

Network Economies: Companies benefit from network effects where increased adoption of their products leads to lower costs and higher value.

Leveraging Brands and Innovations

Strong brands and innovations protected by patents are significant sources of competitive advantage. For instance, pharmaceutical companies like Johnson & Johnson benefit immensely from patents, which allow them to sell drugs exclusively at premium prices, justifying their substantial investments in R&D.

Customer Lock-In and Proprietary Standards

Customer lock-in through proprietary standards and ecosystems, such as Microsoft’s Windows operating system, also creates significant competitive advantages. This strategy makes it challenging for customers to switch to competitors, ensuring sustained profitability and market dominance.

Cost and Capital Efficiencies

Innovative business models and geographical advantages can lead to significant cost and capital efficiencies. Tesla’s direct-to-customer sales model and the proximity of Australian iron ore mines to China are examples of how companies can leverage unique strategies to achieve higher returns on invested capital.

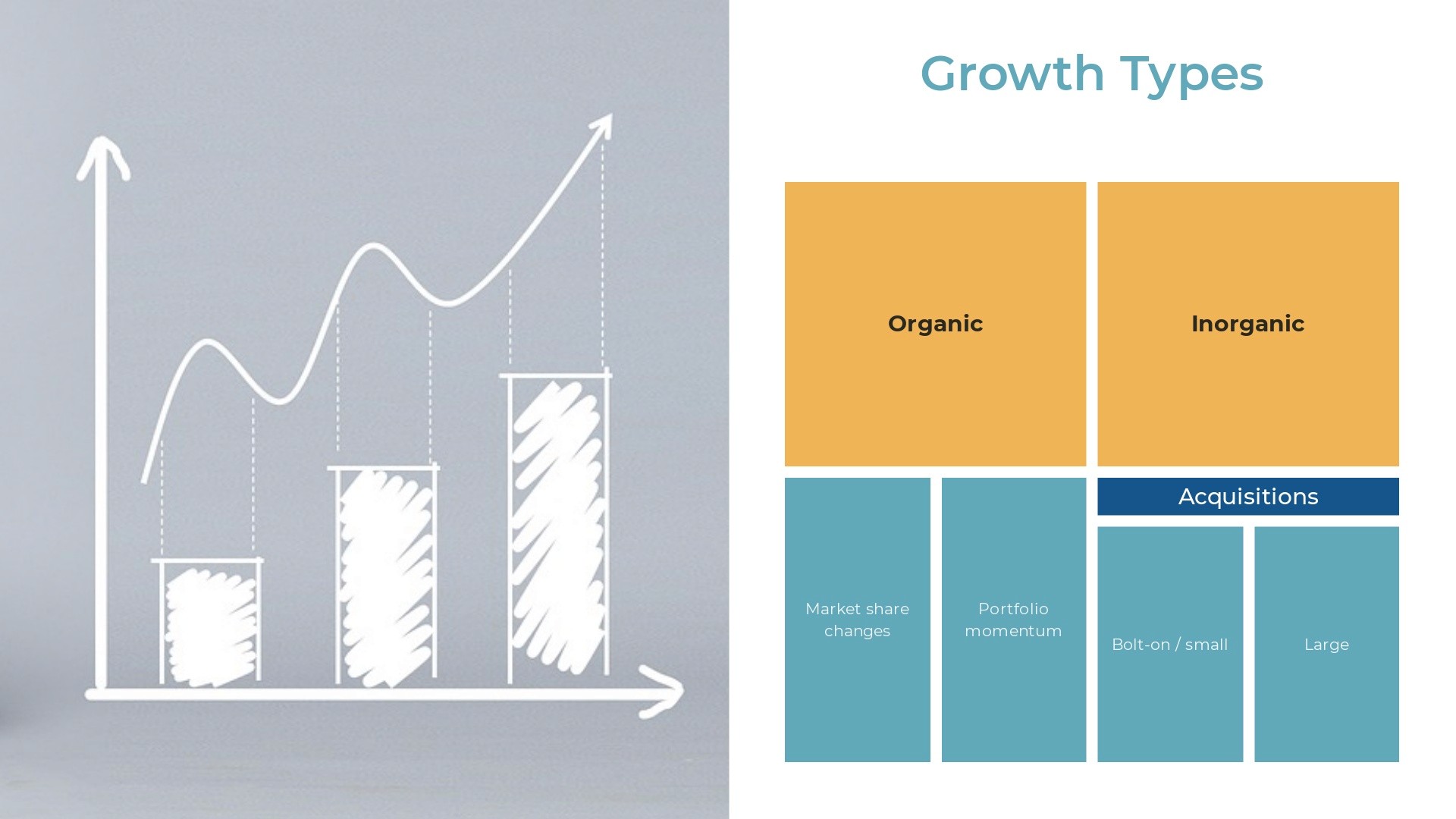

Growth Strategies and Value Creation

Creating value through growth is only worthwhile if the return on invested capital exceeds its cost. Companies with high ROIC should focus on increasing revenue, while those with lower ROIC should prioritize profitability and capital efficiency. Understanding the different types of growth—organic, inorganic, market share capture, and portfolio momentum—is essential for strategic planning.

Challenges of Sustaining Growth

As companies grow, sustaining high revenue growth becomes increasingly challenging. The natural life cycles of products mean that growth rates typically slow down over time. Hence, companies must balance between pursuing new growth opportunities and maintaining their existing high returns on invested capital.

Conclusion

Achieving growth and high returns on invested capital are both vital for creating shareholder value. Companies should focus on profitability and capital efficiency when returns are low and pursue growth when returns are high. By understanding and leveraging the principles of revenue growth and ROIC, companies can make better strategic decisions and unlock maximum shareholder value. Always remember, a long-term perspective is key to sustained success.

***

References / useful reading:

Tim Koller, Marc Goedhart, David Wessels: "Valuation: Measuring and Managing the Value of Companies", McKinsey & Company, 7th edition (6 Aug 2020)